AUGUST 2023

REAL ESTATE MARKET UPDATE

CONTACT US:

425-236-6777

Higher Rates Lead to Housing Market Downturn, but Brokers See Silver Linings

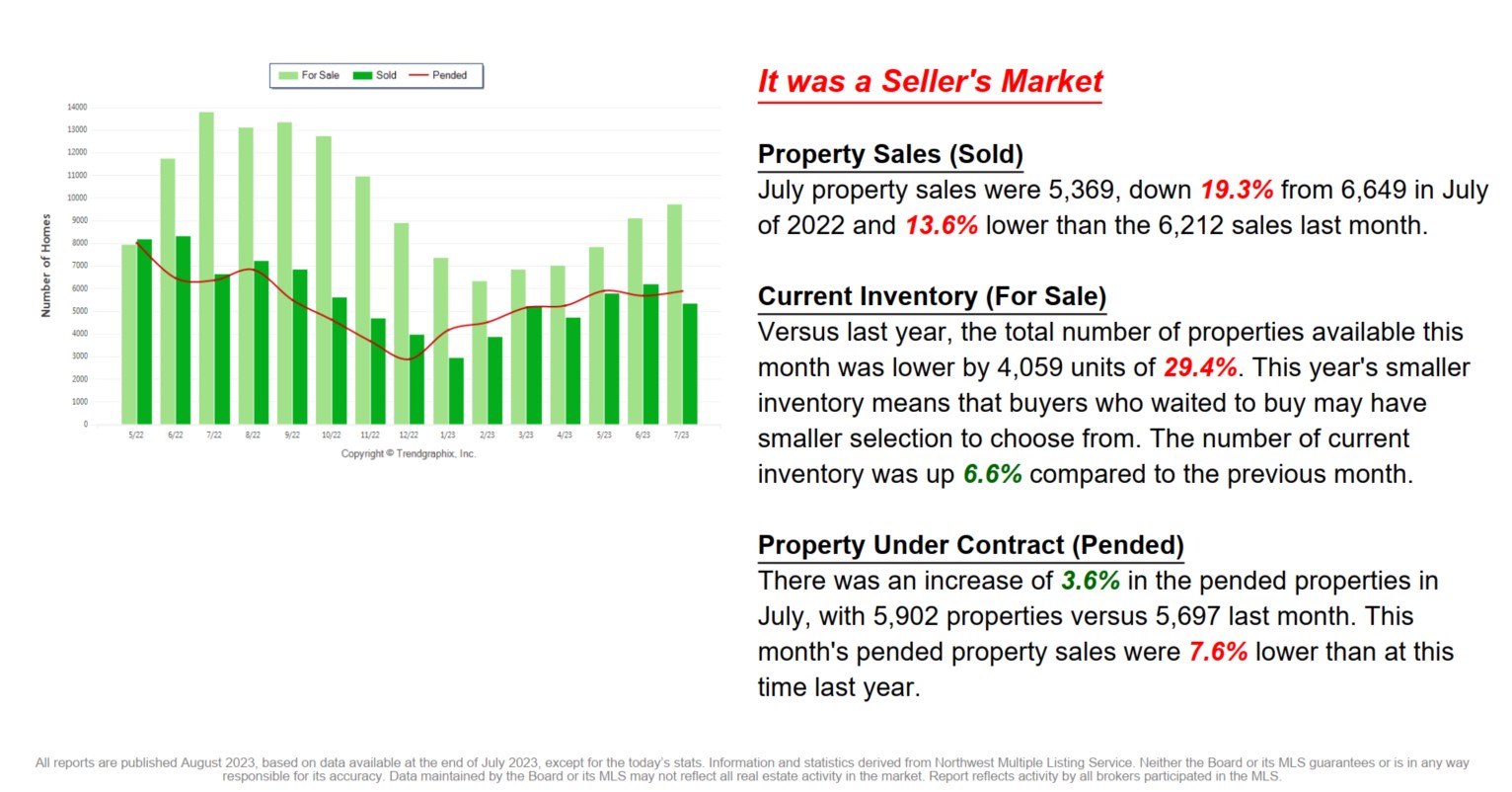

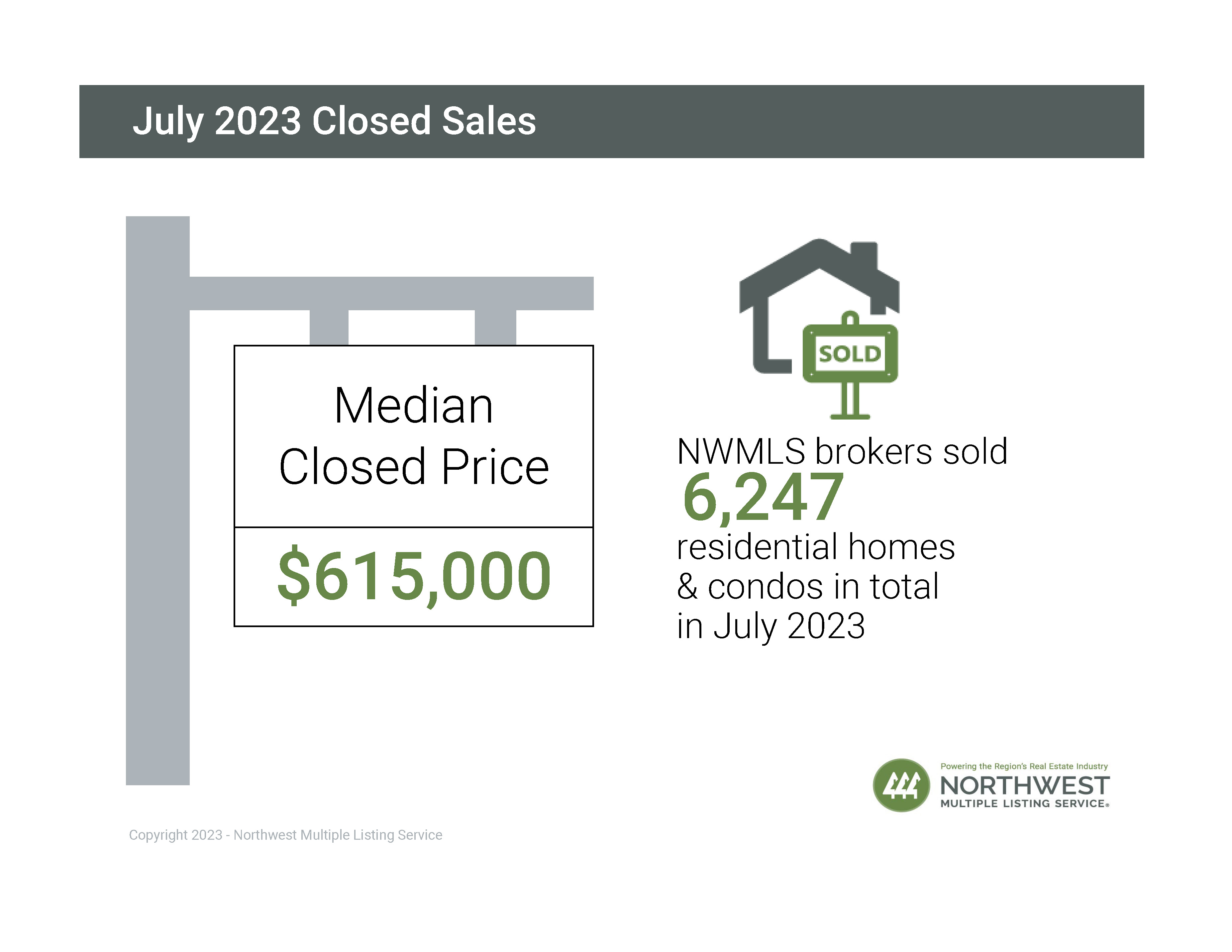

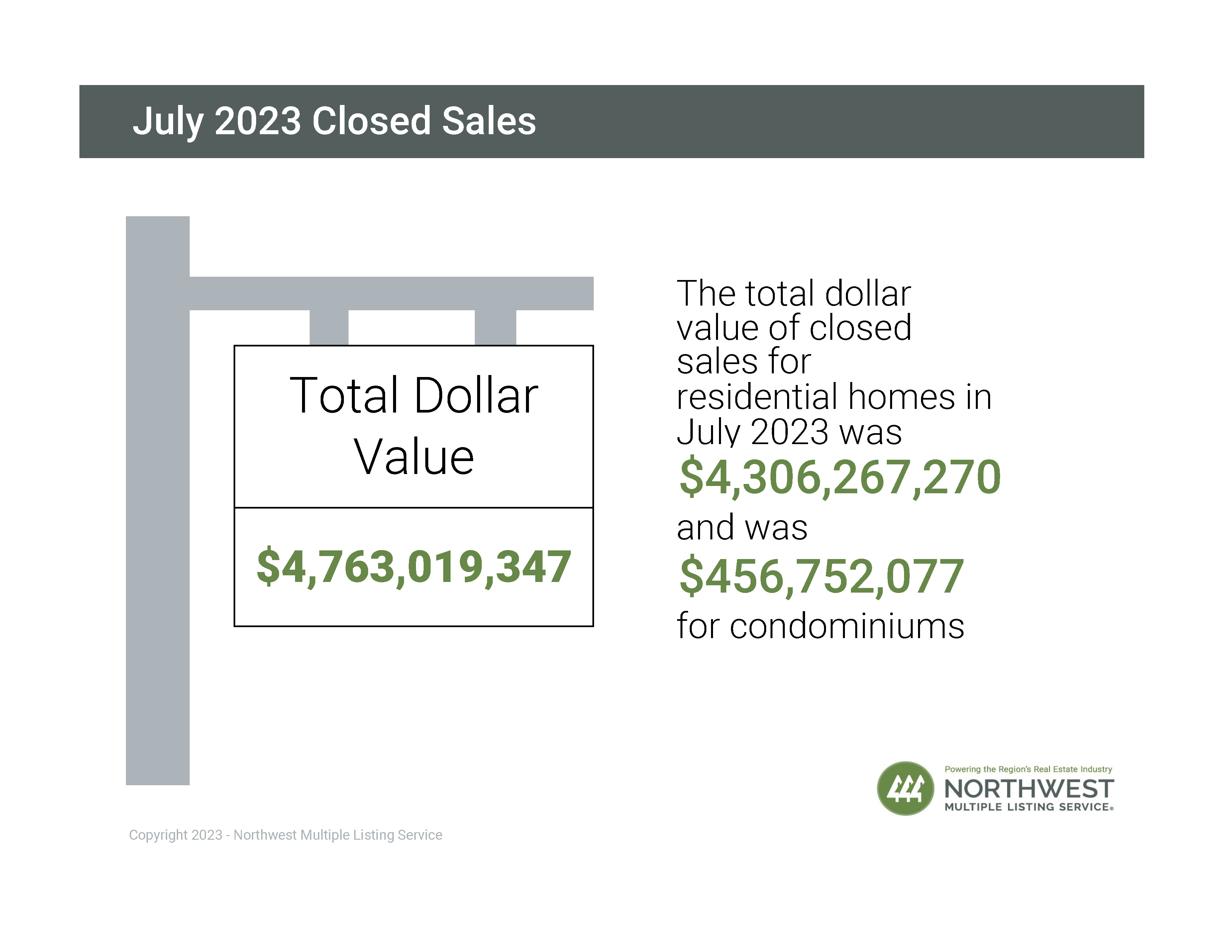

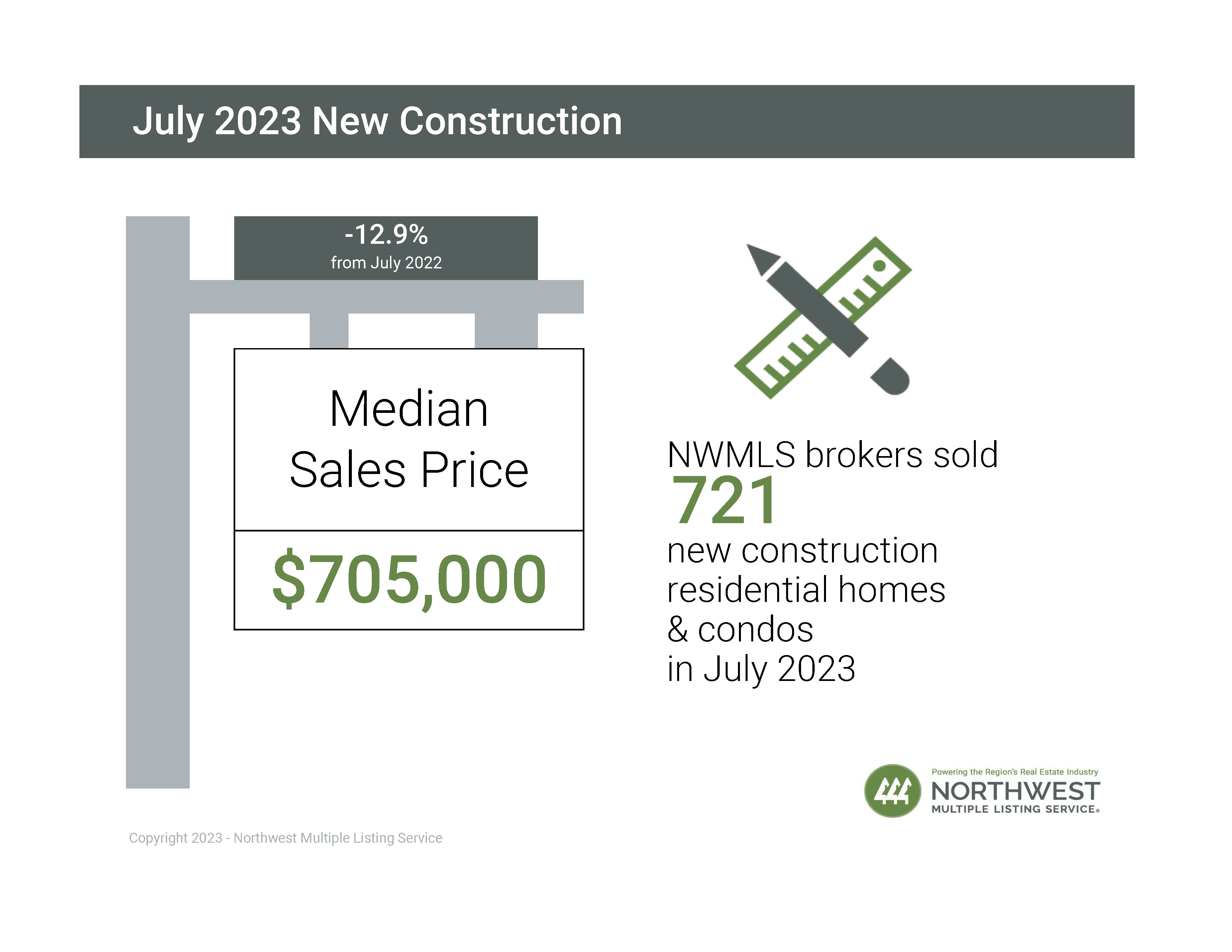

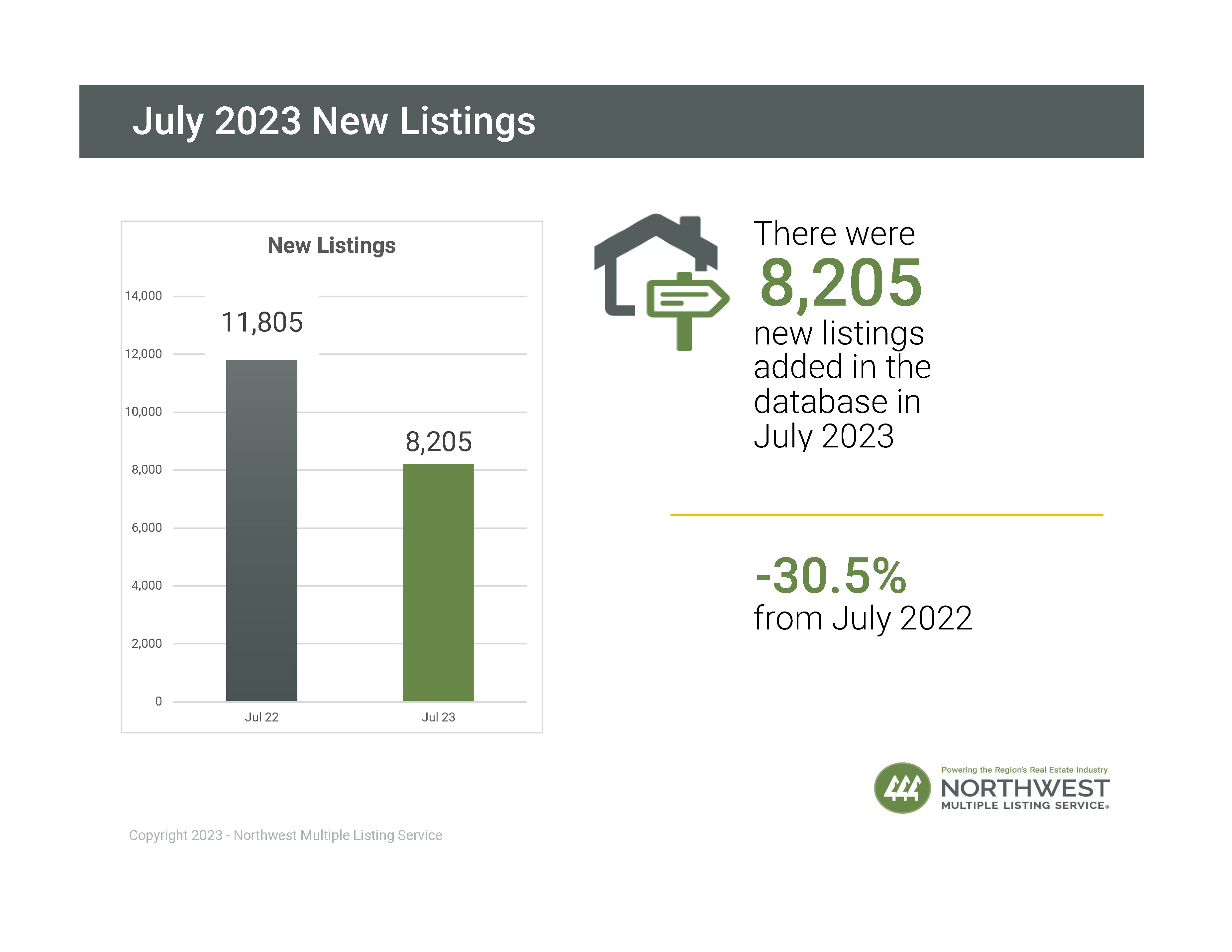

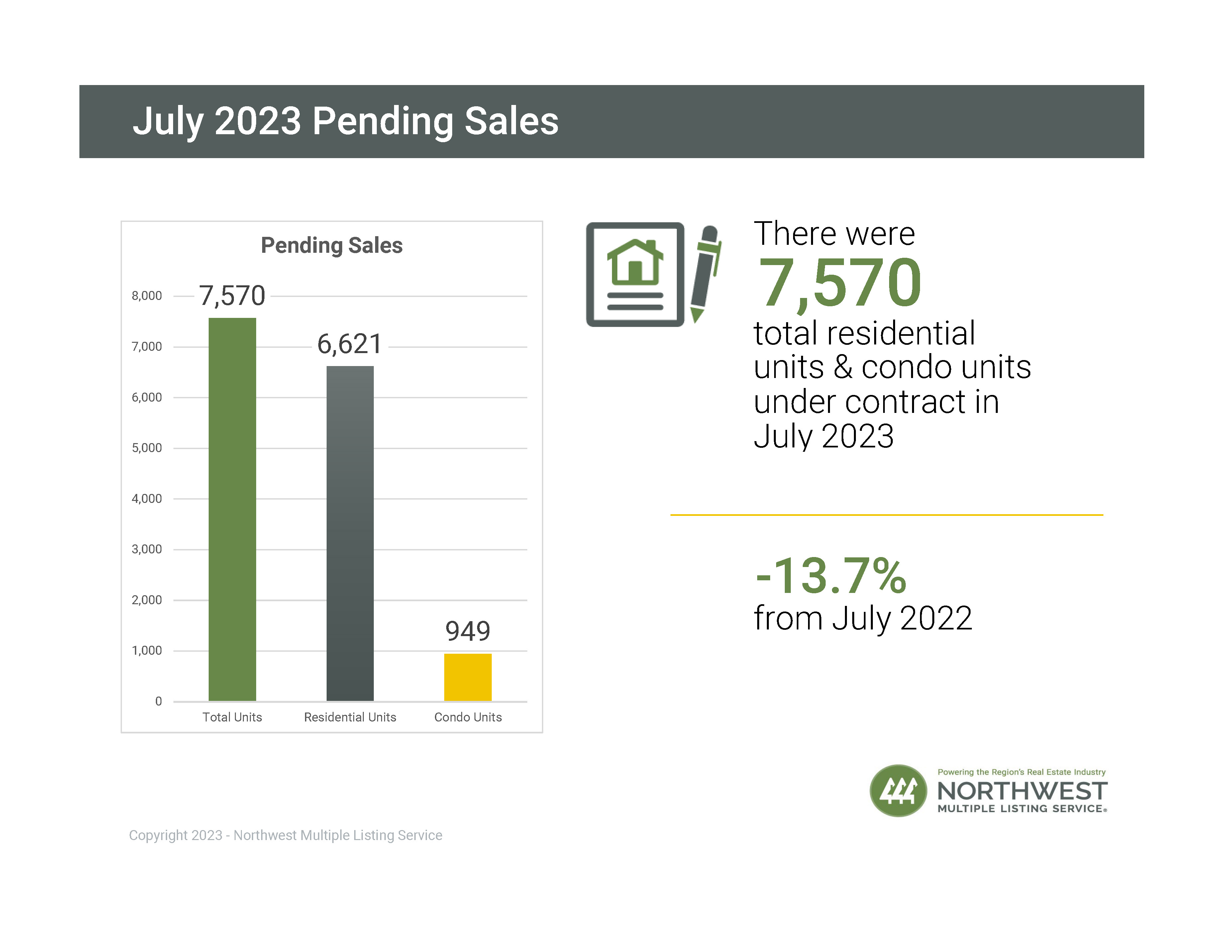

The housing market has experienced a downturn due to higher mortgage rates, which was deemed inevitable. However, recent data from the Northwest Multiple Listing Service showed some positives for both buyers and sellers. Statistics for July across 26 counties highlighted a decline in listings, pending sales, closed sales, and prices compared to the same period a year ago. Notably, the number of homes available for sale dropped significantly, with new constructions unable to meet the current demand.

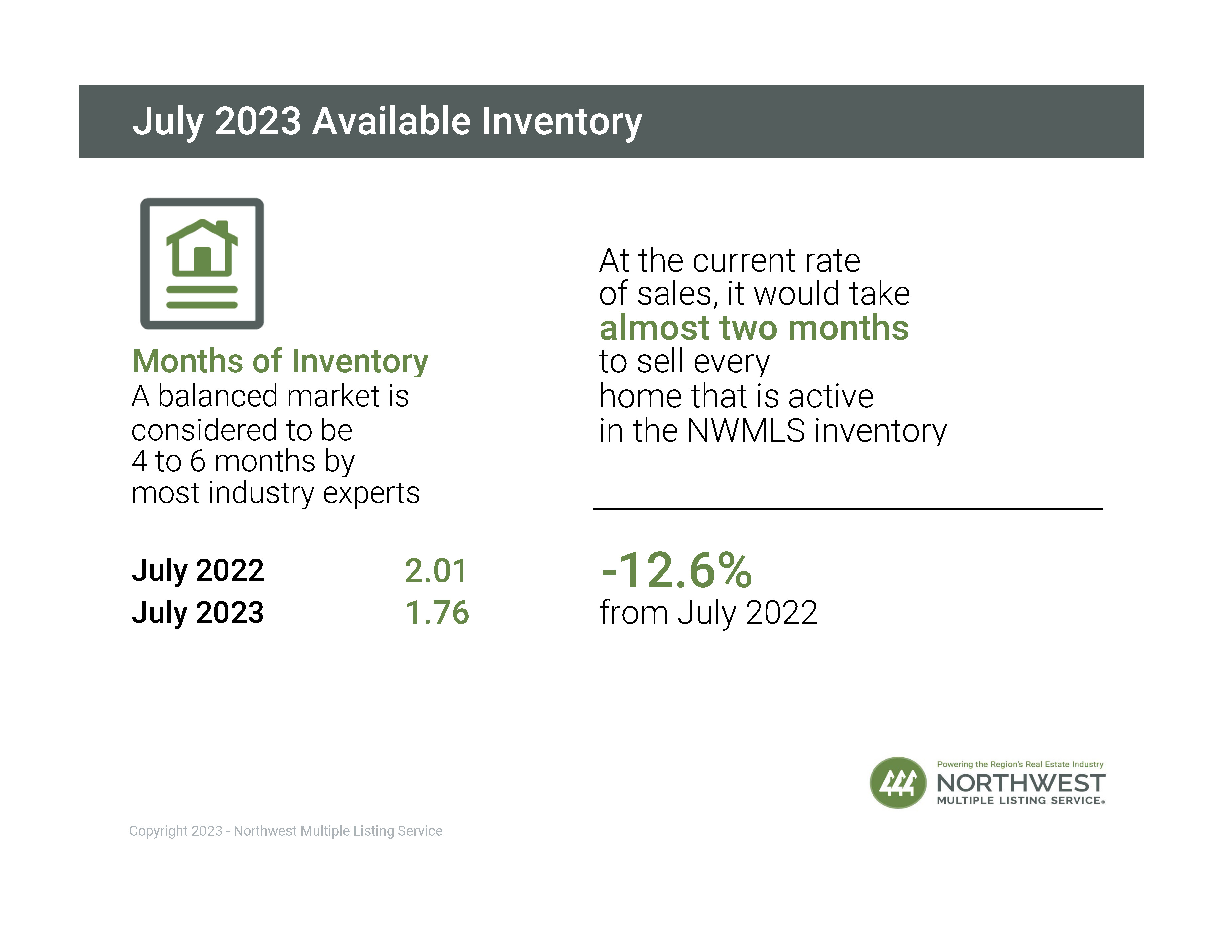

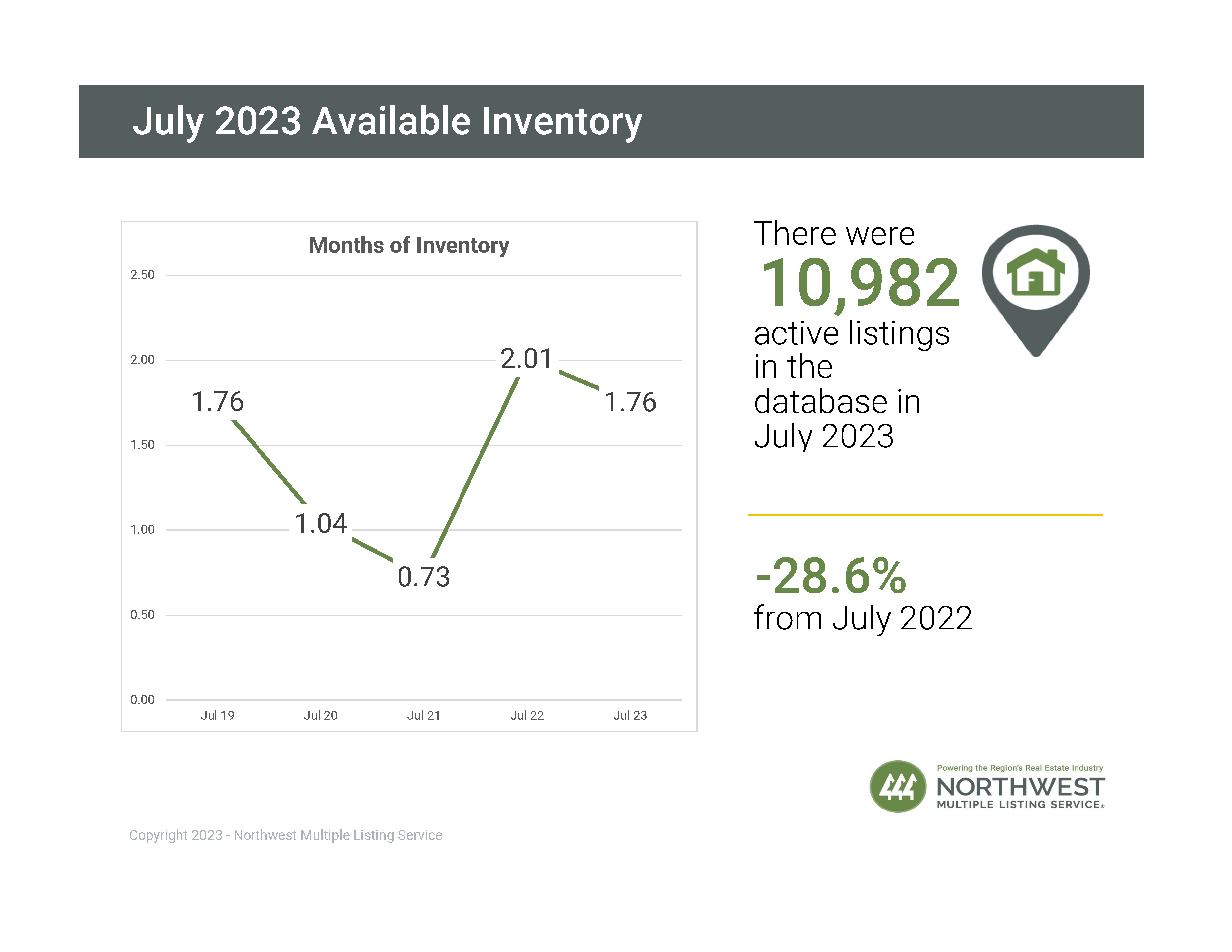

Buyers had a selection of 10,982 active listings by the end of July, an increase of 375 properties from June. However, there was a 28.6% decrease compared to the previous year. This decreased availability, coupled with recent record-breaking price growth, has dampened sales, particularly due to rising mortgage rates. The 30-year fixed-rate mortgage increased to 6.9%, up from 4.99% a year ago. Joanna Harrison highlighted a silver lining: while the housing market remains challenging, some areas saw year-over-year drops in median prices, and buyers are broadening their search to more affordable regions.

Economic predictions, however, offer a mix of caution and optimism. While the immediate future is unclear, with rates unlikely to decrease significantly, industry experts have high hopes for the market in 2024-2025. They anticipate an increase in available inventory with both resale and new constructions, along with a potential reduction in interest rates. Most do not predict a drop in prices. Redfin CEO Glenn Kelman expressed optimism, noting a recession is now seen as unlikely by many economists. The Federal Reserve also recently forecasted that the economy would mostly avoid a recession in 2024, bringing renewed hope for a rebound in the housing market.

NWMLS Market Snapshot - July 2023

George Moorhead of Bentley Properties talks about Inflations Causing Rates To Go Up and Is The Real Estate Market Crashing?

Plus, Top 5 Things You Need To Look For When Getting Mortgage Rates